Intermediate

The Intermediate section in TradeVed is designed for traders with working knowledge of markets — typically with 1 to 3 years of experience. These users have executed trades, understand market cycles, and are ready to operate with more structure in live conditions. The focus is no longer just on learning — it’s about refining and applying.

This stage introduces three key tools: Journal, Screener, and Copy Trading. All features in this section are integrated with live markets and broker connectivity.

Journal

The Journal functions as a personal trading notebook. It helps you record, reflect, and revisit your decisions over time.

Key features:

- Manual trade entries with optional broker-linked tagging

- Add context, screenshots, or notes to each entry

- Tag-based filtering (e.g., setup type, mistake, strategy, sector)

- Designed to build decision-making awareness, not visual stats

This tool supports thoughtful execution. Over time, it becomes your personal reference — showing what worked and what didn’t.

Screener

The Screener is designed to narrow down the universe of stocks or instruments using both technical and fundamental filters.

Key features:

- Remove companies based on loss thresholds (e.g., exclude stocks down 50% YTD)

- Apply technical rules (e.g., RSI < 30, Moving Average crossovers)

- Add financial metrics (e.g., PE Ratio, Market Cap, Earnings Growth)

- Save and re-use custom filter sets

The screener helps you stay focused, cut out noise, and build your own list of actionable opportunities.

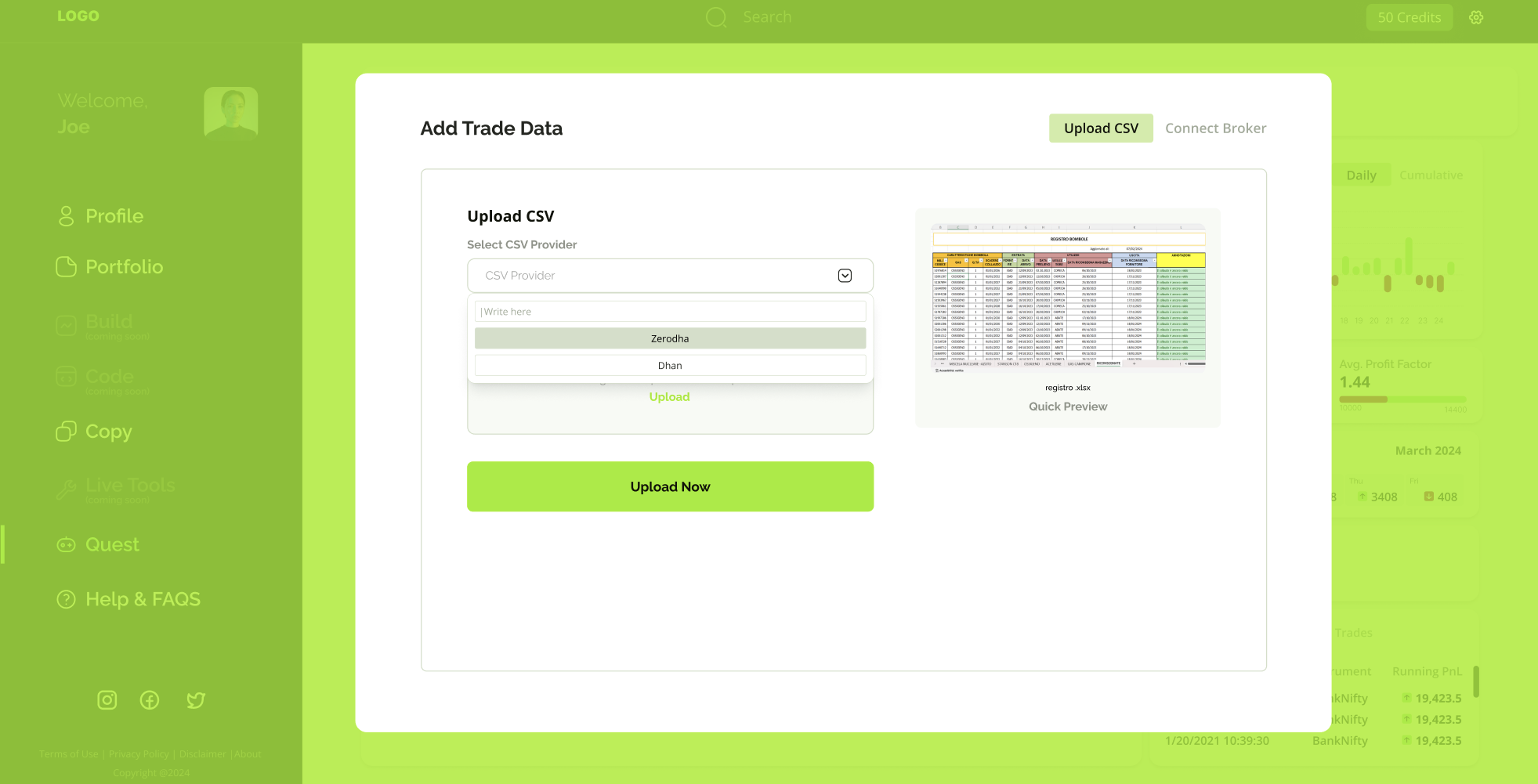

Copy Trading (Broker Connection Required)

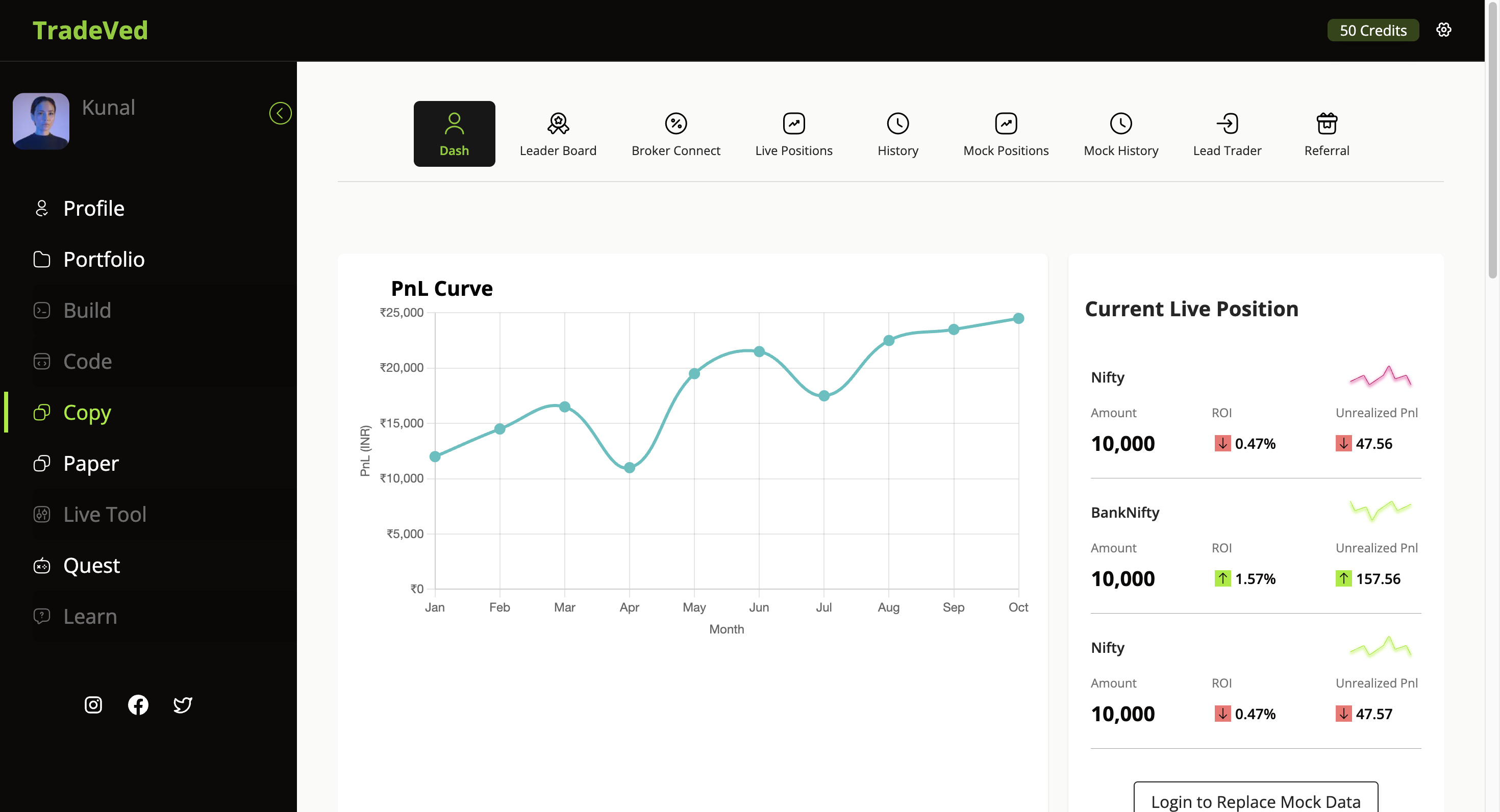

Copy Trading lets you allocate capital to mirror strategies of other verified traders. This is fully user-controlled and designed for flexibility.

Key features:

- Browse and review trader performance profiles

- Set limits before copying (capital cap, number of trades per day, etc.)

- View open and closed positions in real-time

- Stop copying anytime without losing visibility

This tool is especially useful for observing experienced traders, gaining real-market exposure, and learning from strategy flows.

How to Use These Tools Together

You’re encouraged to:

- Use the Journal to log trades and notes — especially where decisions felt uncertain

- Run your Screener daily or weekly to maintain a clean, opportunity-rich watchlist

- Explore Copy Trading for comparative learning and passive diversification

Together, these tools shift your approach from trial-based to process-based trading.

What to Expect

Using these tools, you will begin operating under real market conditions. Unlike simulated trading, decisions now carry weight — emotionally and strategically.

This experience builds:

- Market timing awareness

- Pattern recognition through repetition

- Risk understanding through exposure

- Trade documentation habits

You’re no longer testing ideas in a sandbox — you’re executing in a real environment. These tools help ensure it’s structured, repeatable, and adaptive.